The UK government extended the window for topping up gaps in your NI record, so expats began seeking UK State Pension advice, and applying to boost their UK State Pension back to April 2006 – a full eighteen years’ worth of contributions rather than the usual six.

To qualify, you needed to submit your application (and supporting documents for the lower costs) via post or the online service, or requested a callback online before 5 April 2025. If you did so, HMRC and DWP have pledged to honour your right to pay for every eligible year, even if you’re still waiting for a response after the deadline has passed.

HMRC are currently processing applications received in March 2025.

Official HMRC update as of 13/11/2025

UK State Pension Advice: here’s what happens next

- CF83 application (living abroad), supporting documents (for Class 2 rates), or applied and paid online: as long as the form landed on HMRC’s desk by midnight on Saturday 5 April 2025, you’re in the system (GOV.UK).

- Acknowledgement: Online, most people see an on-screen confirmation immediately, and if you applied by post, you will receive a letter in a few months with a list of possible payable gaps and the cost per year (or email telling you HMRC/DWP have your details.)

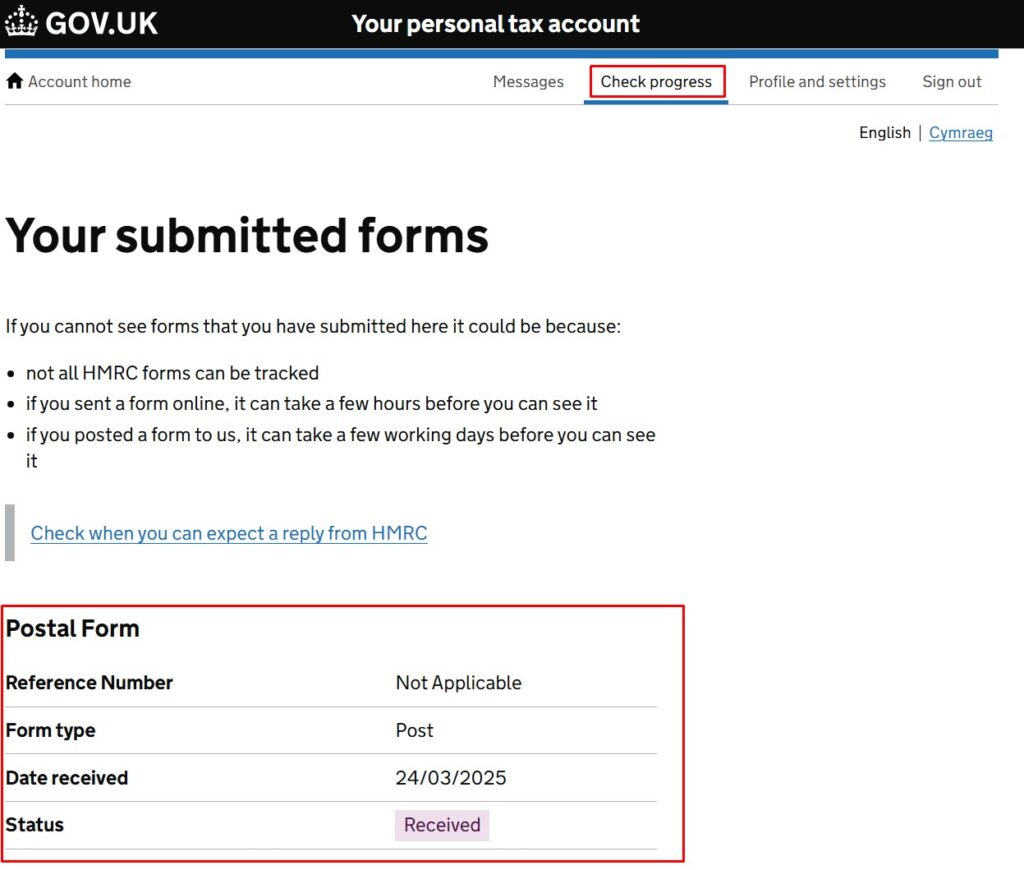

- How you can check: Call the HMRC NI Helpline on +44 191 203 7010, or if you can login to the Government Gateway, create a Personal Tax Account and go to the Form Tracking page to check it’s in the system.

- What they check: class eligibility, employment dates in the UK and overseas, and whether you’ve already paid any of those years. They’ll then calculate how much each year costs (Class 2 or Class 3 rates may apply) and confirm your total.

When to expect a reply to an application (or callback request)

- Allow several months if you applied by post from abroad. They will respond to your chosen correspondence address on the CF83 form.

- Allow up to 8 weeks from the date your online application was received for a full response. Depending on eligibility, many people can go through the system quickly and pay in a matter of hours or days. However, if you applied for the lower Class 2 costs, 8 weeks is the period within which HMRC aim to let you know your approved payment dates, amounts, and any further steps (such as obtaining an 18-digit reference number).

- If you made a DWP callback enquiry (some expats did not apply but requested they be called back): that too should arrive within 8 weeks of your original enquiry, with DWP ringing you back to go through your NI record and next steps.

- Check-in early: if you’ve heard nothing after 8 weeks, call the National Insurance helpline on +44 191 203 7010 from abroad. Keep your reference and NI numbers to hand.

How you’ll get the reply to pay into your UK State Pension

- By post: a letter confirming approval, payment amounts and deadlines.

- Online message: if you used your Government Gateway account, check your secure messages.

- Email: check the Government Gateway if you can, HMRC may email you when the letter’s on its way.

- Call: Be ready between 8am and 5pm, Monday to Friday around 8 weeks from the date of your callback request. You’ll get two chances.

What you should do when the reply arrives

- Review the figures: confirm the years, rates, and total cost. Then GET ADVICE!

- Pay by deadline: you’ll usually get at least 31 days from the date of the letter to make your payment for the years 2006 to 2019.

- Use the right reference: HMRC will give you an 18-digit payment reference. Enter this exactly when you bank-transfer or pay online to avoid delays.

After you’ve paid

- Appearing on your NI record: expect your purchased years to show up within 8 weeks of payment being received (GOV.UK).

- Pension forecast update: once the years appear, log in to your State Pension forecast to see the uplift.

- Every contributed year adds roughly £340 per year to your State Pension entitlement, up to the maximum of 35 qualifying years.

If things go wrong

- No reply by post after several months? Call the National Insurance helpline on +44 191 203 7010 or check your Tax Account.

- No callback/email within 8 weeks? Ring HMRC’s National Insurance enquiries line (details on GOV.UK).

- Payment not showing after 8 weeks? Contact the NI helpline and quote your payment reference. In rare cases, manual allocation can run longer (some have reported waits up to 39 weeks, though that’s unofficial and usually applies to older payments) (HMRC Community).

Missed the deadline?

contact us today

You’ll still be able to buy back the last six years and pay ongoing

Do you want to pay less?

Appeal your Class allocation.

Bottom line

By submitting your enquiry or application by 5 April 2025, you’ve locked in the ability to pay for up to 18 years of missing National Insurance years, allowing you to boost your future UK State Pension.

Now it’s a matter of getting proper advice.

If you want lower costs

If you end up with Class 3 quotes at about £825 per missing year, instead of Class 2 at about £150…